Debt can either be a stepping stone to success or a trap that ruins lives. For entrepreneurs and everyday people alike, the way you handle loans determines your financial future.

In his book Making It Big, billionaire businessman Femi Otedola gave a timeless warning:

“Never divert loans to bankroll your lifestyle. Do not spend your projected profit. Pay off your debt before you start living like a king.”

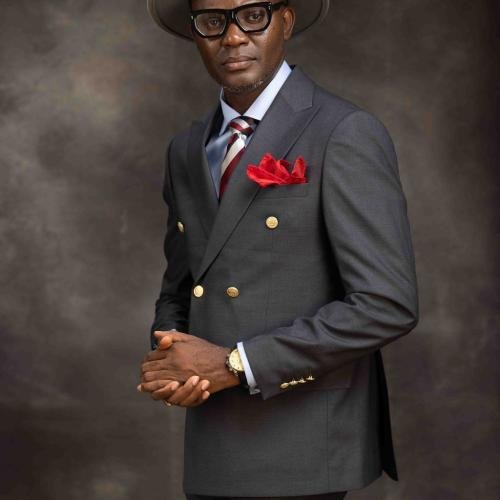

Prince Adelaja Adeoye shared this truth, reminding us that discipline with money is the foundation of sustainable wealth.

Why This Advice Matters

Loans Are Not Free Money – They are obligations that must be repaid, often with interest. Misusing them for luxury digs deeper holes.

Projected Profits Are Not Guaranteed – Markets can change. Relying on expected profits for spending is financial recklessness.

Debt Before Lifestyle – Clearing debt first ensures peace of mind and financial freedom before luxury spending.

Common Mistakes People Make

Using business loans to buy cars, clothes, or fund parties.

Spending tomorrow’s income today by borrowing against expected profits.

Celebrating too early after securing funding, instead of focusing on repayment and reinvestment.

What Successful Entrepreneurs Do

Discipline First: They prioritize paying off debt.

Reinvest Profits: Instead of spending, they grow businesses with returns.

Live Modestly Early: They delay luxury until their wealth is sustainable.

Lessons for Nigerians and African Entrepreneurs

In Nigeria, many young entrepreneurs fall into the trap of using investor money or bank loans to showcase wealth. But true business success comes from reinvestment, discipline, and debt repayment—not fake luxury.

Conclusion

Wealth without discipline is short-lived. Otedola’s advice is a clear reminder: pay off debts, grow your investments, and then live well. Real kings are not those who borrow to look rich, but those who build wealth sustainably.